The Rise of Employment and Small Businesses

16 January 2012

Good news: the possibility of a double-dip recession is becoming bleaker. The Bureau of Labor Statistics has reported that the unemployment rate decreased to 8.5%, the lowest it’s ever been since February 2009. More than 150,000 jobs had been created, especially in the areas of health care, mining, manufacturing, retail, and warehouse. Consumer borrowing, based on Federal Reserve’s report, also went up last November 2011, the biggest monthly gain since November 2001.

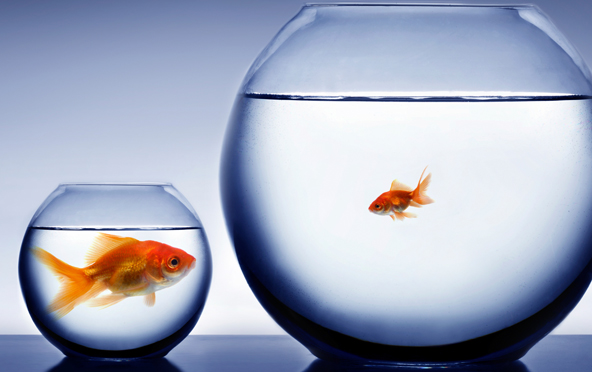

Interestingly, though, majority of the job ads didn’t come from more stable and huge companies, those with 500 or more employees. They were “looking for” posts from small businesses. These are the ones that have been badly hit by the slowly growing economy for the last 4 years, as reported by William Dunkelberg, chief economist of the National Federation of Independent Businesses. In November 2011, for example, around 200,000 private jobs were created, yet only 37,000 came from large-scale companies. The rest were from small businesses. Moreover, many are expecting for hiring to increase in 2012 as more people will open their own small businesses. If this were to push through, it would be a far cry from what the industry suffered in 2007: there were more failed businesses than new ones.

In spite of the bright picture, there are some serious challenges small businesses have to address or contend with. One is the lack of right people to do the job. For instance, if the small-based company has adopted certain technologies, it then becomes mandatory to hire someone with the appropriate technical skills. This poses a problem for laid-off workers too, since they may not get their jobs back.

Second, there are still a number of banks with strict credit standards, making it quite difficult for small businesses to obtain loans. They cannot open their businesses on time, compete in the market, or expand their enterprise.

There’s also the volatility of the international market, especially countries in Europe, such as the United Kingdom, Spain, Italy, and Greece. Though the European Central Bank is working on providing more long-term and less-risky solutions than bailing out harshly affected banks and countries, it’s still not an assurance things are getting brighter in this side of the world.

The Possible Solutions

There’s no doubt small businesses will continue to play a huge role in a more stable U.S. economy in 2012. What is essential then is the assurance it continues to stay afloat or even improve within the next 12 months.

Needless to say, the small business sector cannot do this alone. It requires the assistance of the government, who has to strengthen small business policies and create guidelines that are beneficial to them. It is also necessary to understand the changes in the needs of small businesses, particularly in employment skills, and determine ways on how to bridge the gap. It may offer tech programs or short courses for current and potential in-demand positions.

The Federal Reserve Bank should strive to maintain a lower interest rate and monitor banks that charge excessive loan charges or implement stringent credit rules.